How to Increase Your Credit Score

06/11/19

A FICO (Fair Isaac Corp.) credit score is a three-digit number that represents the likelihood of a consumer’s ability to repay a loan. In addition to mortgage companies who use the data for loans and rates, it might also be used by insurance companies when setting premiums, landlords evaluating potential tenants, or cell phone companies when offering plans and rates. It’s important to know what your credit report contains(Opens in a new window) in case there are errors.

What is my score?

To be clear, a credit score is not just one score. There are actually three main credit bureaus that provide FICO scores: Equifax, Experian, and TransUnion. They collect, sell, and store data about individual consumers’ credit histories. Each bureau may have slightly different scores and data for you.

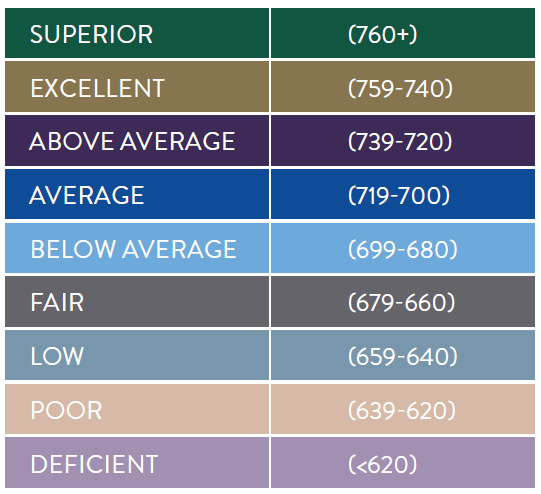

The government’s Consumer Financial Protection Bureau has some suggestions(Opens in a new window) for obtaining your scores and has many online resources(Opens in a new window) dealing with reports and scoring. Credit scores range from 300 to 850 and are commonly broken down into categories ranging from Deficient to Superior.

Pay bills on time

One way to make sure your credit score is good is to make all of your payments by the due date. One day late is still late— be strict with yourself. Consider signing up for text alerts or automatic payments using your bank’s bill pay system. Some payees can also set up automatic bank drafts to make payments directly from your checking account when they are due. About 35 percent of your credit score has to do with your ability to make on-time payments, so be militant about doing so.

Avoid ‘maxing out’ credit limits

Using too much of your credit limit will hurt your score. About 30 percent of your FICO number depends on having lots of wiggle room in the amount of credit you use versus how much credit remains on the account. Can you ask for a credit increase? Do you need to consolidate balances on cards where you’re using too much of your limit? Some experts advise using only 30 percent of the credit available to you, while others say to only use 10 percent of your limit. In either case, be aware of how much credit you use and make sure it doesn’t approach anywhere near the maximum allowed.

Don’t over-apply

It can be tempting to get that store discount, but be aware that applying for new accounts can hurt your credit when too much of it is occurring within a short time span. Every time you open an account or fill out a credit card application, your credit will be impacted. It’s best to do so sparingly.

Pay the balance every month

You can build good credit by paying off the balances on accounts every month. Pay on time, every time and you’ll improve your credit. Not only that, but paying off the balance in full will save on interest fees, which can often be extremely high.

These are just a few items of interest when dealing with a credit score. At Sunflower Bank and First National 1870, our first priority is your financial well-being. If you have questions about improving credit or you’re ready to try our 8 Essential Financial Tips, we want to make it easy for you. Find a location near you or call us at 888.827.5564.