Upon Further Review 1Q 2023: The Importance of Diversified Fixed Income

04/10/23

INTRODUCTION

For those of us hoping the tumultuous financial market dislocations seen in 2022 would abate and give way to a more tranquil investment landscape to start the year, the first quarter of 2023 had decidedly different ideas. A rally in US equities – specifically large cap and growth factor names – commenced in the opening weeks of 2023, before pulling back following the Silicon Valley Bank black swan event in early March 2023. Somewhat surprisingly, markets largely proved resilient, as fears surrounding small and mid-sized banks lessened and a more accommodative Federal Open Market Committee (FOMC) posture brought down terminal rate expectations. Lessons abound from recent events, and against this backdrop, this quarter’s Upon Further Review examines the significance of diversification within fixed income portfolio allocations.

FIXED INCOME DIVERSIFICATION MOTIVES & SPECIFIC RISK FACTORS

Much as including a bond allocation acts as means of diversification to equities in a composite portfolio, diversification within a fixed income allocation presents further opportunities to enhance risk-adjusted fixed income returns through risk mitigation measures. For the purposes of this analysis, we spotlight two central fundamental risks specific to fixed income securities: interest rate risk and credit risk.

-

Interest Rate Risk: An inverse relationship exists between bond prices and interest rates: as interest rates rise, bond prices fall as the present value of future coupon and principal payments declines relative to new issues with higher rates. A bond’s sensitivity to changes in interest rates is measured by duration. The longer the duration, the more sensitive the security is to a rise or decline in interest rates. Duration is a critical component of interest rate risk, and one need look no further than the March 2023 forced receivership of Silicon Valley Bank (SVB) by the FDIC to understand why. SVB exposed itself to a classic example of duration risk by funding short duration liabilities (deposits) with long duration assets (bonds). When a large number of depositors wanted to withdrawal their money, SVB was forced to sell greatly depreciated assets in order to provide the requested funds leading to a liquidity failure.

-

Default/Credit Risk: Credit (or default) risk refers to the primary risk of an issuer of a fixed income security failing to make timely payment of principal or interest on the bond in question. To a further extent, credit risk can also reflect the possibility of a deterioration in credit quality of an issuer, due to either company-specific or macroeconomic developments. As a result, the issuance is downgraded by ratings agencies and is re-priced lower by secondary markets to reflect the higher risk of possible default. An issuer may enhance debt covenants of a bond, specifying contractual obligations of the issuance. Often, these covenants address collateralization, liquidity metrics (such as debt-to-equity ratios), or a restriction on future borrowings as means for an issuer to further augment the fixed income security’s creditworthiness, and thus its value relative to other fixed income offerings.

DEFINING THE FIXED INCOME INVESTABLE UNIVERSE

In contrast to the equity investable universe, the fixed income landscape offers far more specification and types of issuance. Treasury and Agency securities for government sponsored enterprises such as Fannie Mae and Freddie Mac, represent the vast majority United States sovereign debt. Municipal debt, which offers considerable client tax advantages as it is most often exempt from federal taxation, is offered by local, county, and state agencies to fund local initiatives. Furthermore, there are bonds issued by corporations to fund ongoing activities and can be secured by recurring cash flows or underlying assets (asset-based securities). These examples serve to highlight the vastness of fixed income offerings and offer perspective on diversification within a bond portfolio.

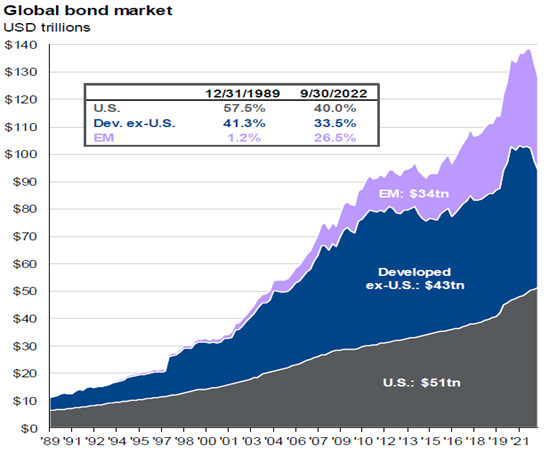

Perhaps most interestingly, as shown in the chart below, as of 2Q 2022, the United States represented approximately 40% of global fixed income issuance outstanding1, with the remaining ~60% of global bond issuance across both developed and emerging international markets.

Source: JPMorgan Asset Management |

Bottom line: the diversity of these fixed income asset class offerings, maturity durations, credit quality profiles and geographical reach offer a number of avenues to enhance fixed income portfolio diversification, as differing correlations among these instruments present the opportunity for optimized fixed income risk mitigation, as interest rate changes affect each subclass differently.

SUNFLOWER FIXED INCOME PORTFOLIO CONSIDERATIONS

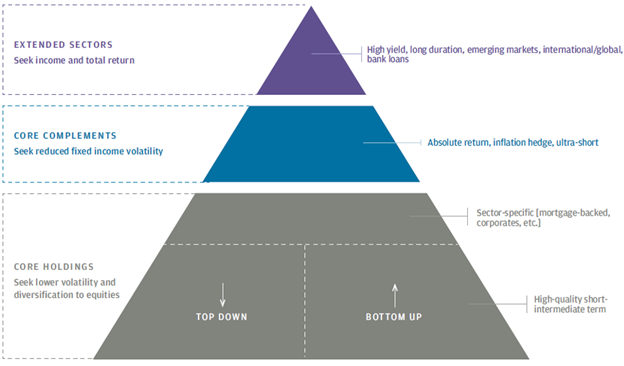

With an understanding of these two fundamental risks and the universe of fixed income products, we can now consider tangible applications to fixed income portfolios. Sunflower utilizes a core-satellite approach within our fixed income portfolio, whereby our core holdings of high-quality sovereign and corporate debt pair with core complements and extended sectors, which provide an additional layer of diversification benefit and return opportunities by accessing both developed and emerging international debt markets as well as high-yield offerings.

Source: JPMorgan Asset Management |

In 2022, anticipating a rising interest rate environment as the FOMC sought to quell the possibility of inflation expectations becoming entrenched, we elected to shorten duration in our model portfolios, while also expanding portfolio exposure to variable (or floating) rate product (which organically lessen duration by resetting monthly or quarterly to prevailing market interest rate levels). The repositioning appears prescient in hindsight, as the rise in the federal funds rate served as an unremitting drumbeat throughout 2022 while also causing a deep inversion in the yield curve leading to the largest drawdown in the Bloomberg U.S. Aggregate Bond index in over 40 years 2.

Entering 2023, we decided to lengthen duration in our model portfolios while increasing credit quality, informed largely by the broader global economic outlook and the belief that the US yield curve inversion would eventually re-steepen. Early results appear promising: after the Federal Reserve and Treasury Department took unprecedented steps in the March 2023 process of shoring up confidence in the banking industry, the two-year treasury yield declined nearly 150 basis points (1.50%). For context, this decline in the two-year represents a sharper clip than anything witnessed during the Great Financial Crisis of 2008 or the Great Lockdown of 20223.

As of today, there are diverging views of the path that interest rates will take in 2023. Some expect rates to rise further and stay elevated through year-end. However federal fund futures are currently pricing in 75-100 points of rate cuts, which suggests fixed income volatility will likely stay elevated over the near-term. The only certainty of how fixed income markets will play out of the remaining three quarters of the year is that there will be uncertainty. Now more than ever, a diversified bond portfolio is an effective tool in managing these nuanced fixed income risk exposures.

REFERENCES

1 Securities Industry and Financial Markets Association: https://www.sifma.org/resources/research/research-quarterly-fixed-income-outstanding/

2 J.P.Morgan Asset Management, Guide to the Markets 1Q 2023

3 Hamilton Lane Weekly Research Briefing, @bespokeinvest:

Weekly Research Briefing | Hamilton Lane

DISCLOSURES

For more information about our Wealth Management services, speak to your relationship manager or visit the Wealth Management pages of SunflowerBank.com and FirstNational1870.com.

Investment and insurance products are not FDIC-insured, are not a deposit or other obligation of, or guaranteed by the bank or an affiliate of the bank, are not insured by any federal government agency and are subject to investment risks, including possible loss of the principal amount invested.

General disclosure: This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. This material may contain estimates and forward-looking statements, which may include forecasts and do not represent a guarantee of future performance. This information is not intended to be complete or exhaustive and no representations or warranties, either express or implied, are made regarding the accuracy or completeness of the information contained herein. The opinions expressed are as of April 10, 2023 and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks.